Microfinance Software

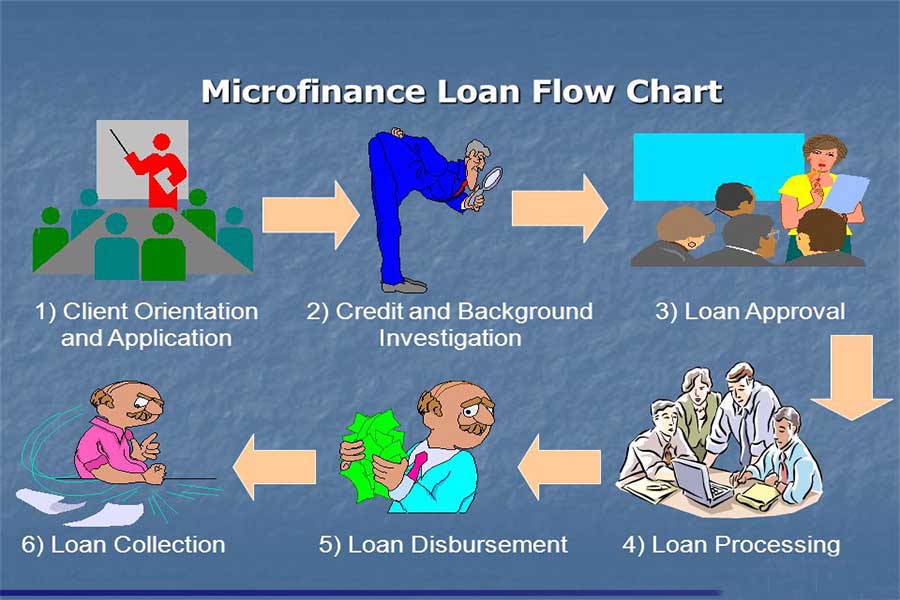

Manages all your microfinance business-related tasks from loan originating, micro project management, loan processing, muli bank support, multi notification, multi fraud detection in the loan, loan recovery a complete microcredit lifecycle

MFI Software

We have developed a software especially to manage your microfinance business. Our software is developed for the microfinance business known as 'v-Micro'.

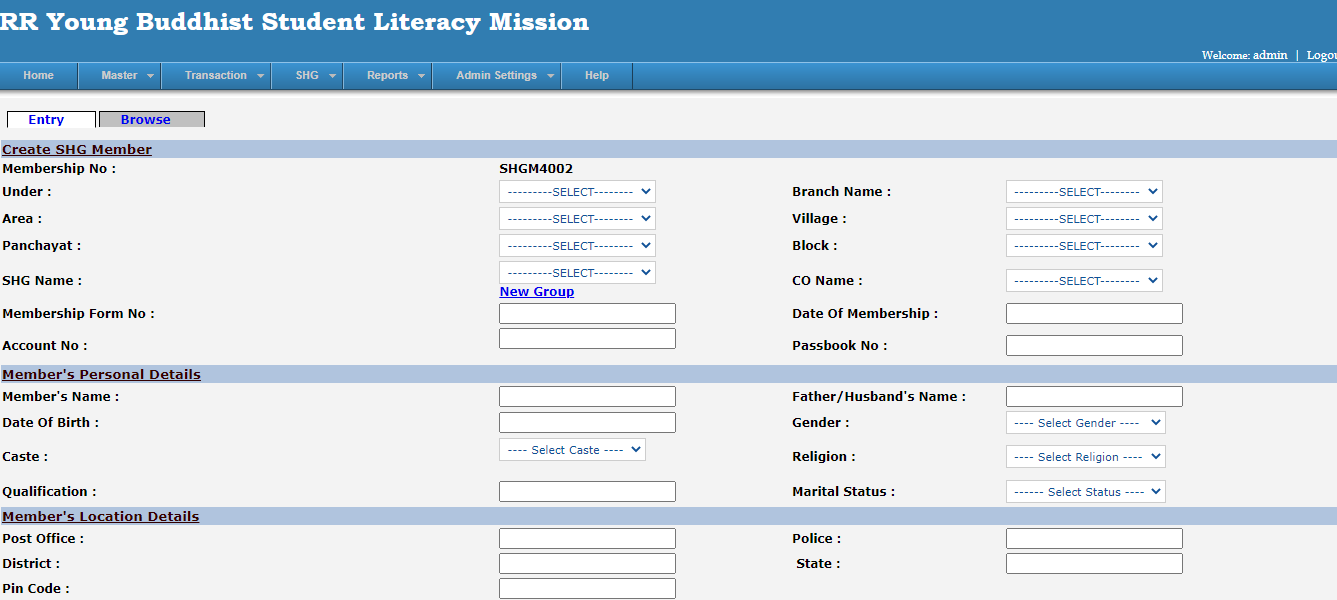

This microfinance software, v-Micro is very useful for managing your microfinance business-related activities. Using this microfinance software you can create Self Help Group, individual registration into the group, and collection officer.

Microcredit Software

Using our microfinance software you can manage easily the loan application, document submission, loan disbursement, loan agreement, and collection. v-Micro is the software that has been used in Microfinance organizations.

We started to develop the microfinance software in the year 2006 till date we are upgrading the software as per market demands and trends.

SHG Loan Software

We have added new features from time to time after taking feedback from our existing clients and our marketing team. v-Micro is one of the best microfinance software in recent years.

We have added a lot of features and upgraded the technologies for the ease of your business. v-Micro is the microfinance software, this software will help you to manage your microfinance organization.

Microcredit Software Details

Features and functionalities of Microfinance System software and Self Help Group Management. Microfinance organization works mainly with the poor and villagers people. In a Microfinance organization, the primary users or customers are the woman, less educated lower middle class, or poor class. This organization works in villages and rural or semi-urban areas.

SHG Loan Software

- Location Details

- Country, Sate, City

- Area, Block, Taluka

- Panchayat, Village

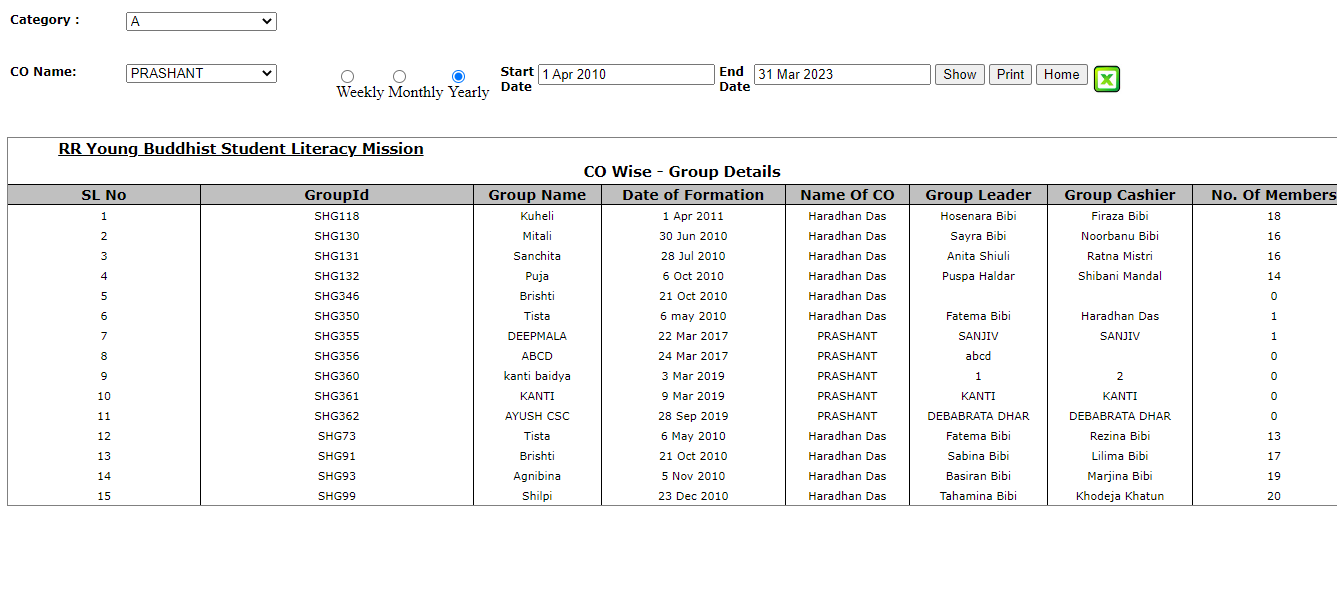

- SHG Group Creation

- Member Registration

- KYC Documentation

- Bank and Mobile Verification

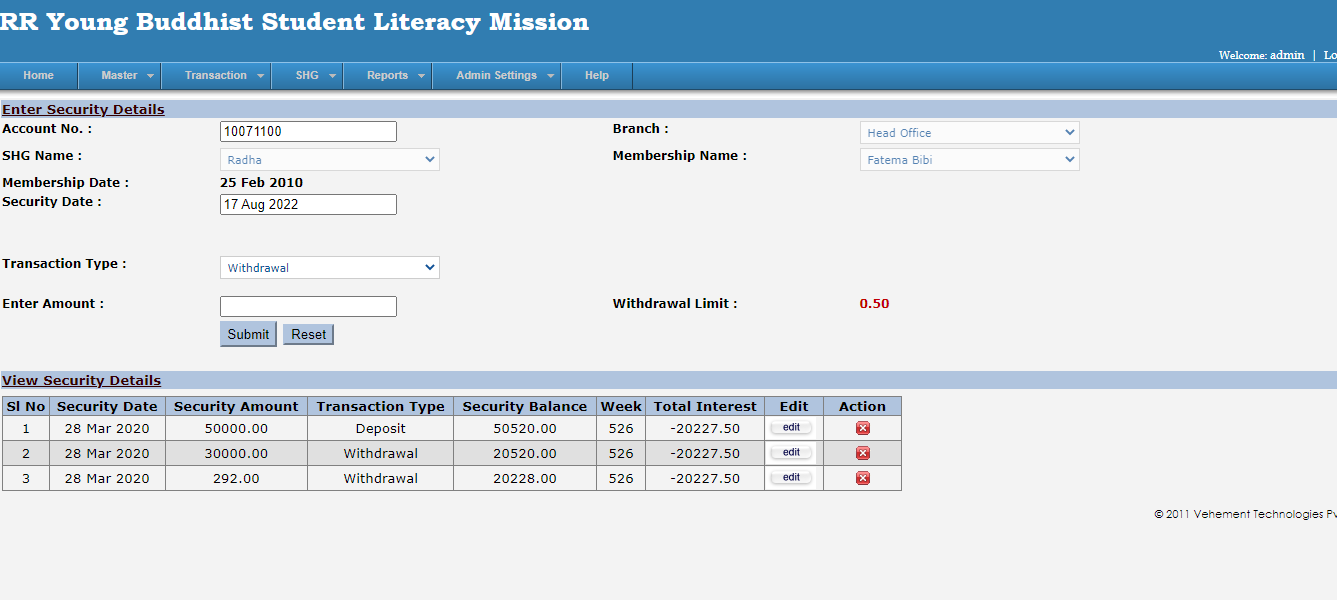

- Security Money Deposit

- Security Money Withdrawal

- Project Submission

- Documentation and Approval

- Loan Application

Microcredit System

- Loan Documentation

- Interest and EMI Calculation

- Loan Approval

- Loan Agreement

- Loan Disbursement

- Laon Recovery

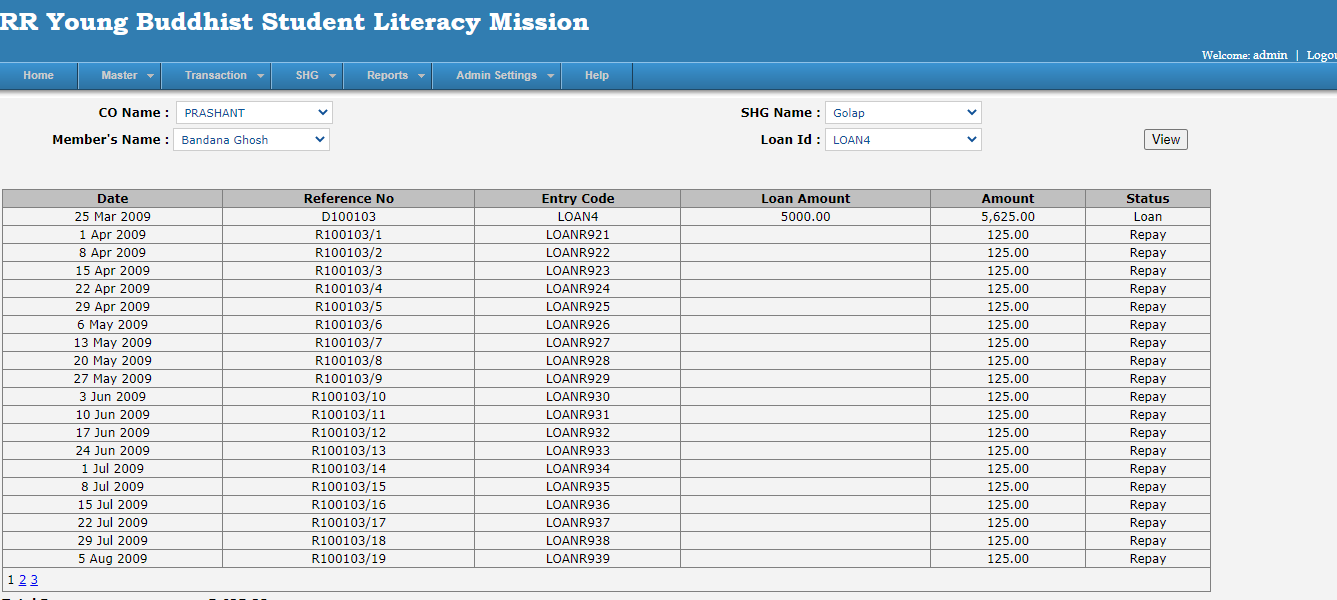

- Daily Loan Collection

- Weekly Loan Collection

- Loan Collection Fortnight

- Monthly Loan Collection

- Group, Individual wise Collection

- Area wise Due & collection list

- Loan Cancelation

MFI Software

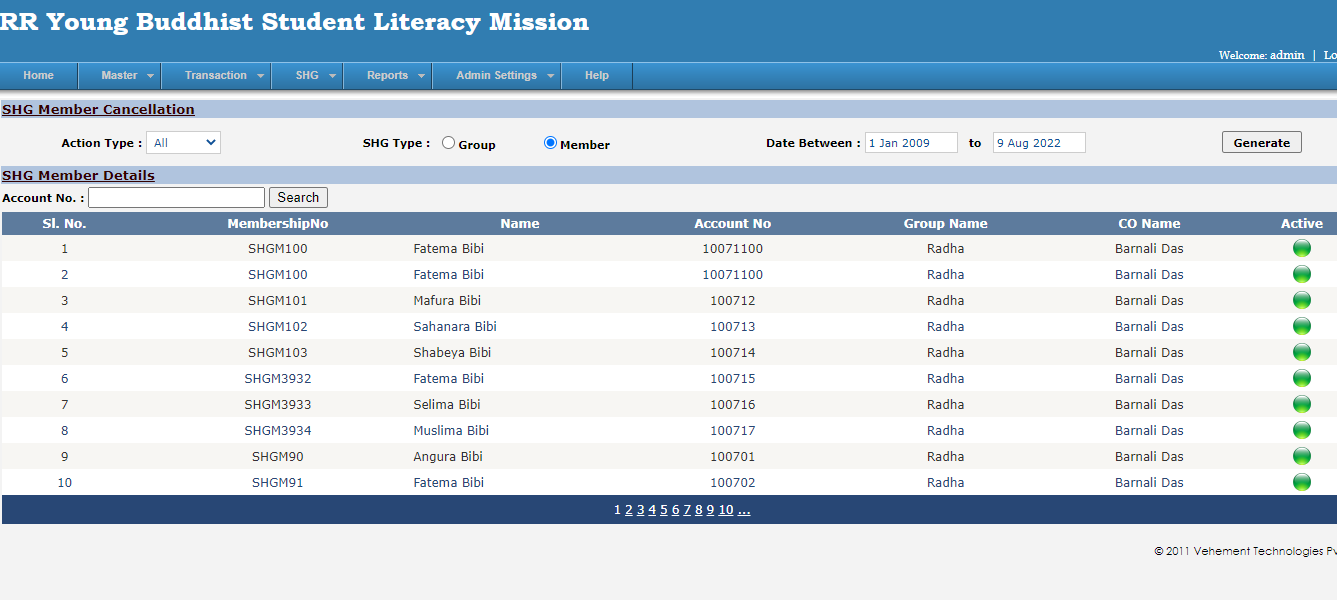

- SHG Cancelation

- Member Transfer

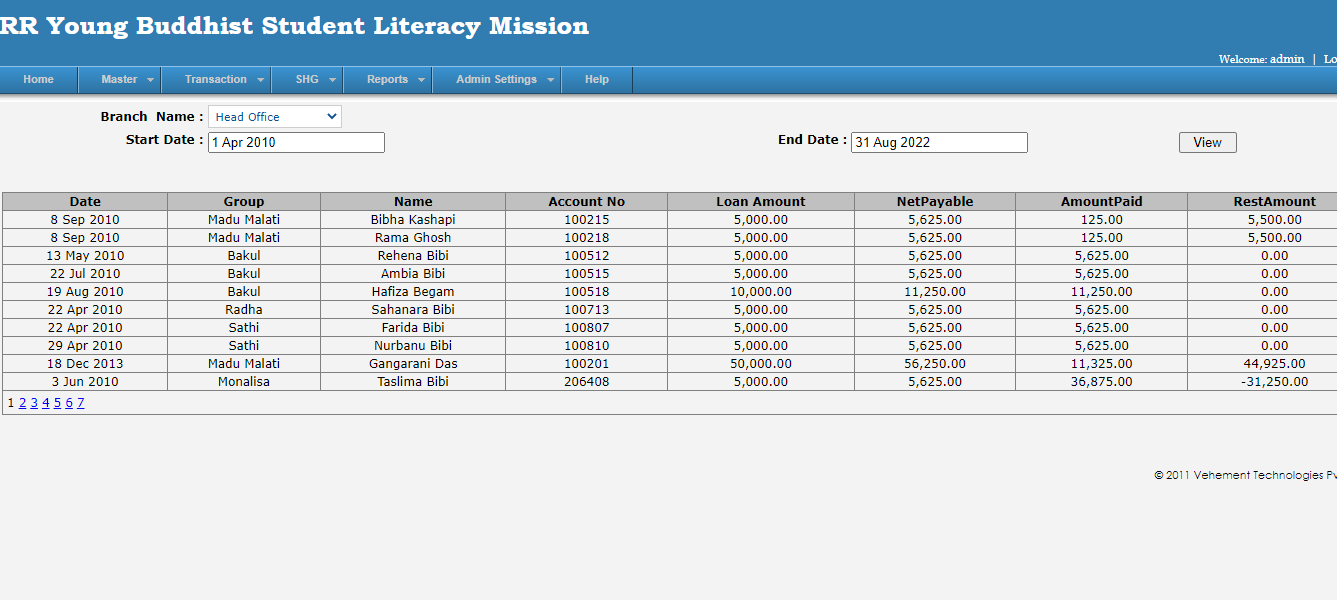

- Loan Statement

- Loan Passbook

- Loan Defaulter

- Loan Register

- Collection Officer Register

- Group Head details

- Loan Completion - NOC

- Bad Loan

- Branch Expanse

- Accounts & Finance

- Inventory Management

v-Micro Microfinance Software Price and Subscription Fees

v-Micro - One of the best Microfinance Software for Microfinance related organizational activites

Subscription Fees: $99 / month / end user

- One Time setup & Configuration fees $1000 for end user package

- For v-Micro – Microfinance Software Source Code copyright, white-level software: $5000 once in a life time for v-Micro – Microfinance Software

- This source code fees $5000 is Not applicable for end user, it is only applicable for the user who are intersted for source code

Benefits of Cloud based Microfinance system

we have developed the software 'v-Micro' in such a way that it will be easy to maintain these types of users. Most of the software screens are interlinked and click-based and required less amount of user interaction.

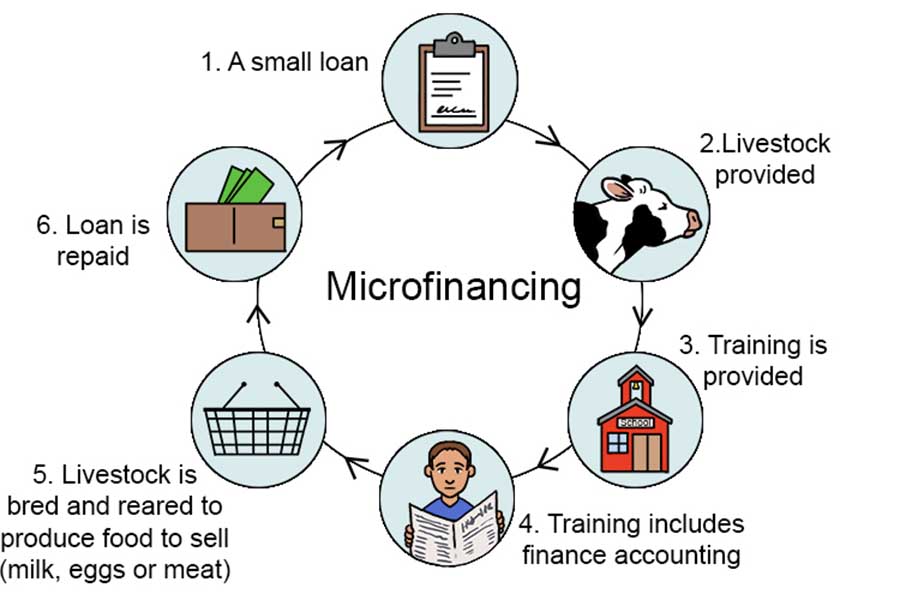

Microfinance Software Steps

Steps followed in Microfinance Company business management. We have followed the same process in our Microfinance software 'v-Micro' from Group Creation to Loan Processing to the loan recovery process, The entire microfinance life cycle is described step by step

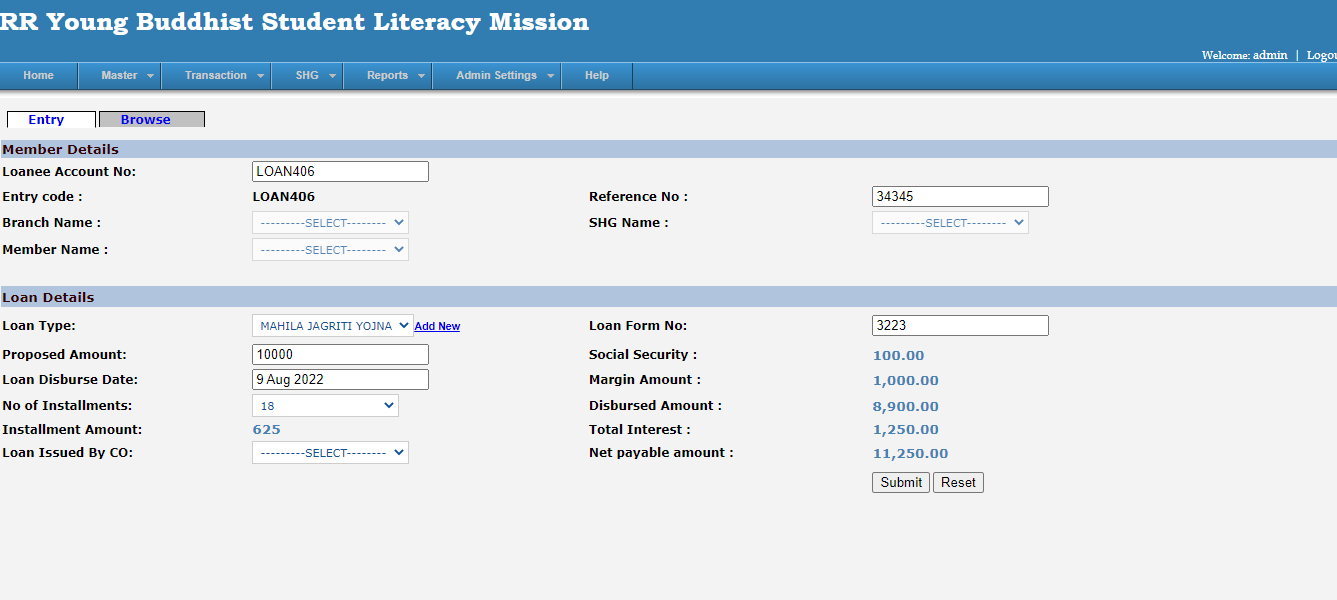

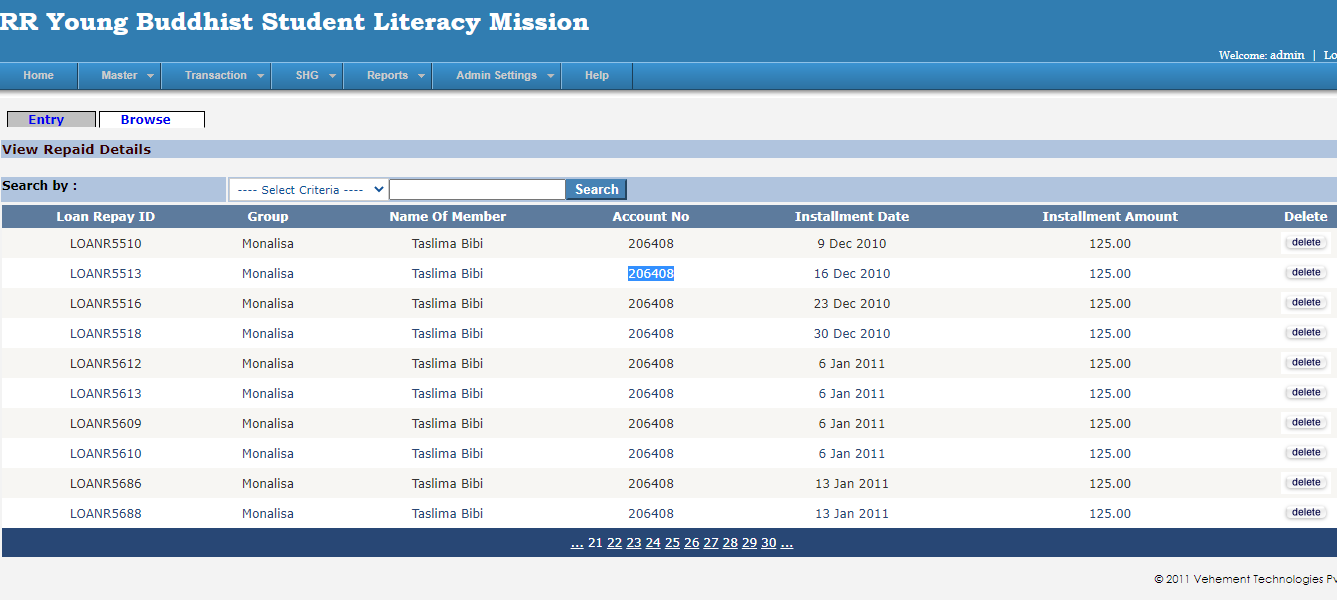

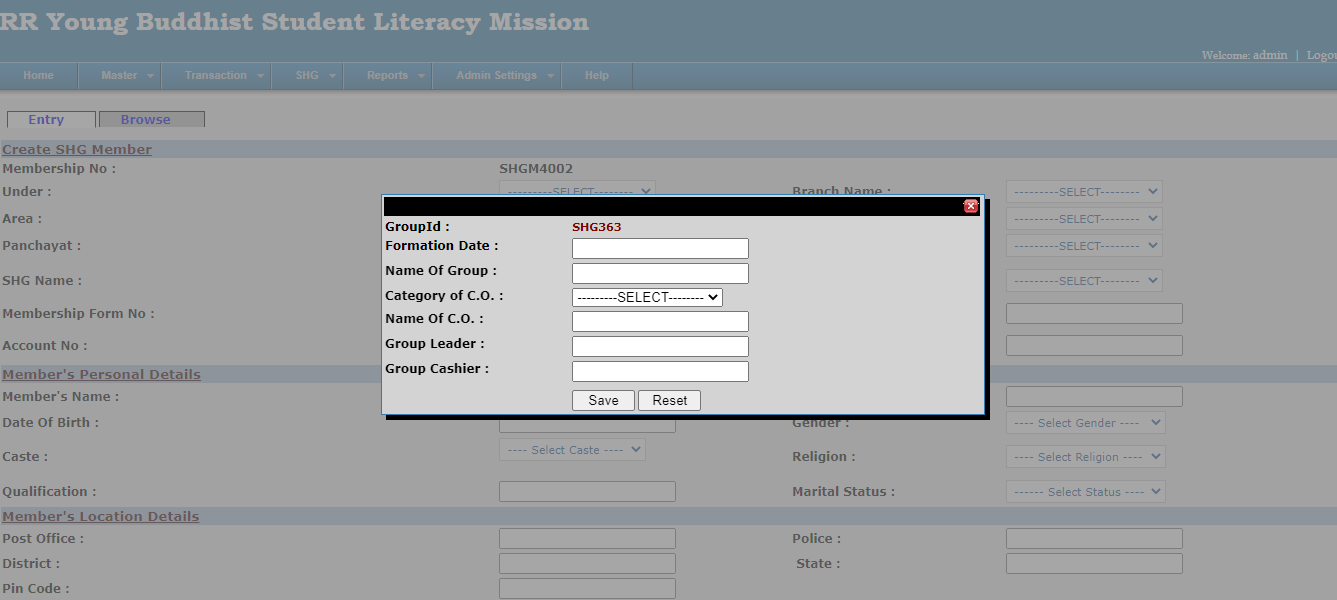

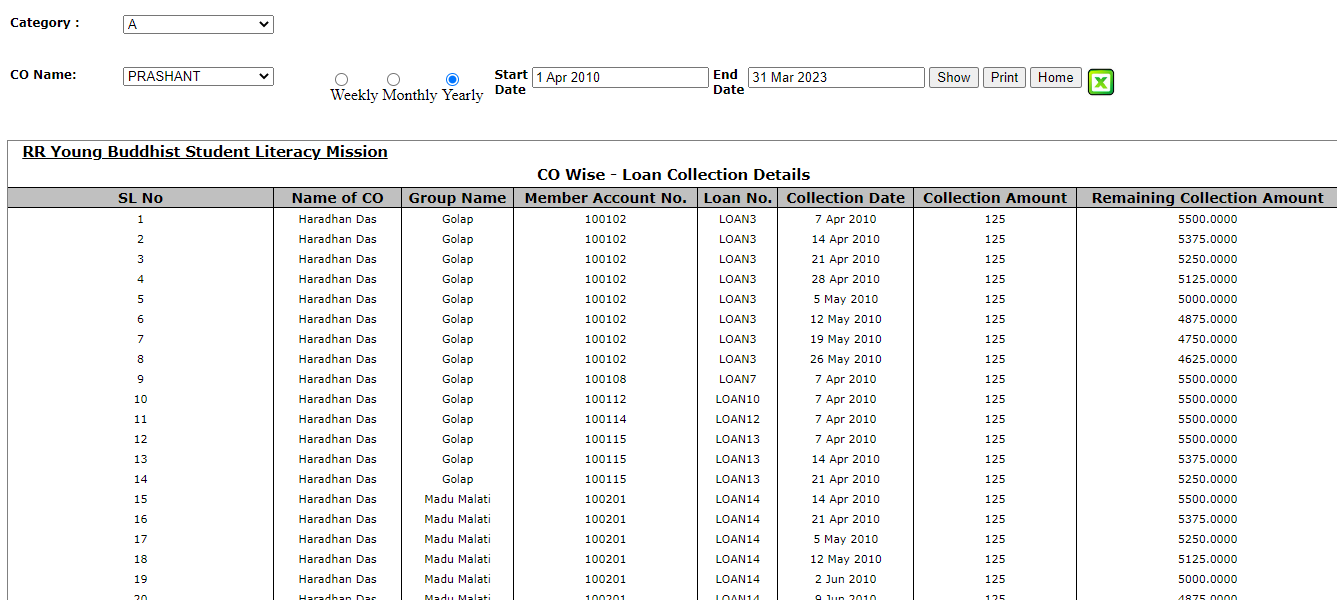

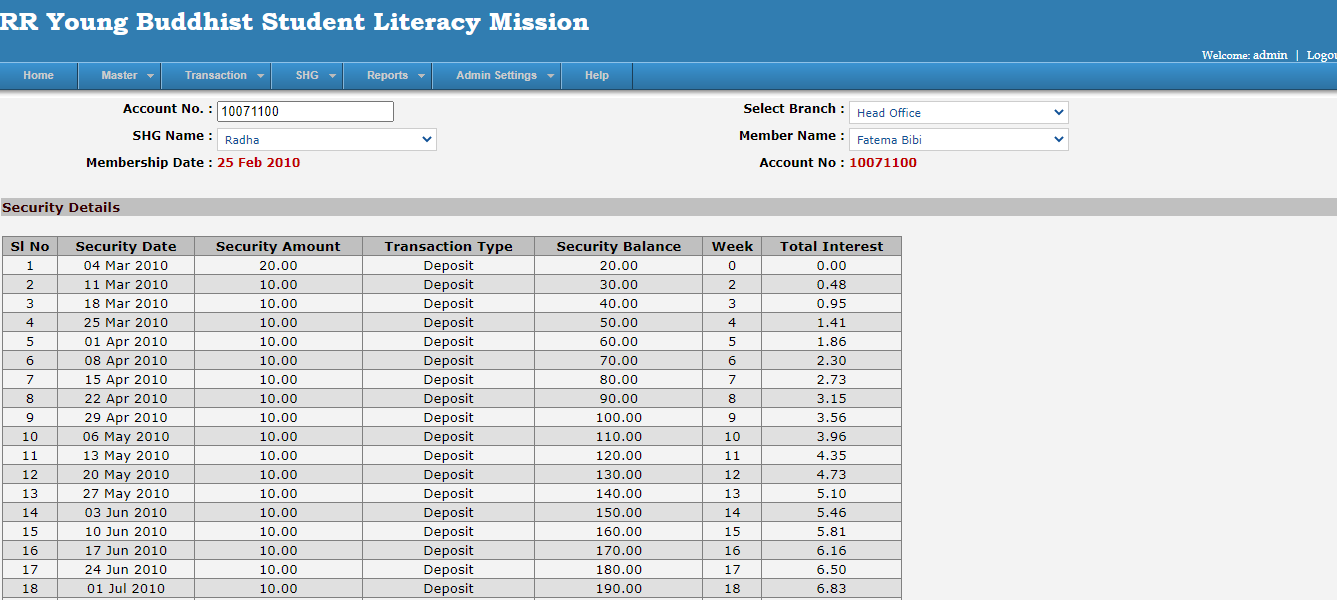

SHG Loan Software Company Screenshot

There are more than 55+ screens in Microfinance System Software which include an entry screen, transaction screen, and report screen. For a sample demo only some of the features in Microcredit Softwar system screenshot provided. Entire features of the Microfinance Software you will get in the video demonstration link and in the live demo link of the ERP system

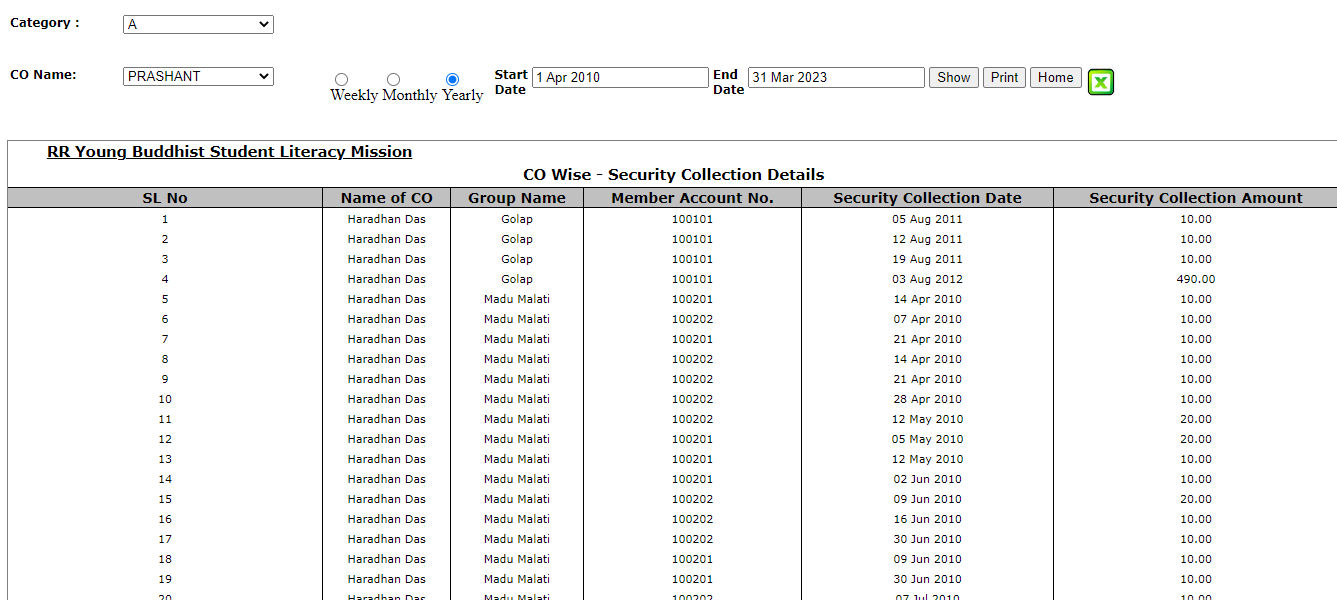

Collection Officer - Loan Collection

Security Collection CO Wise in MFI

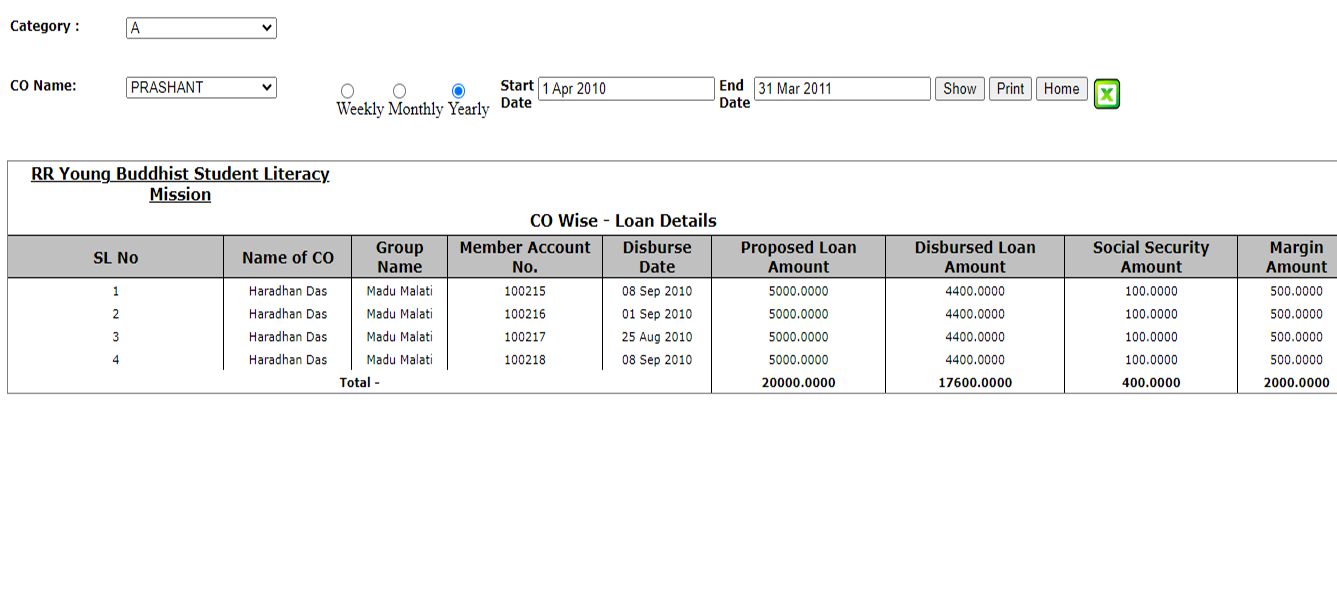

Loan History CO Wise in Microfinance

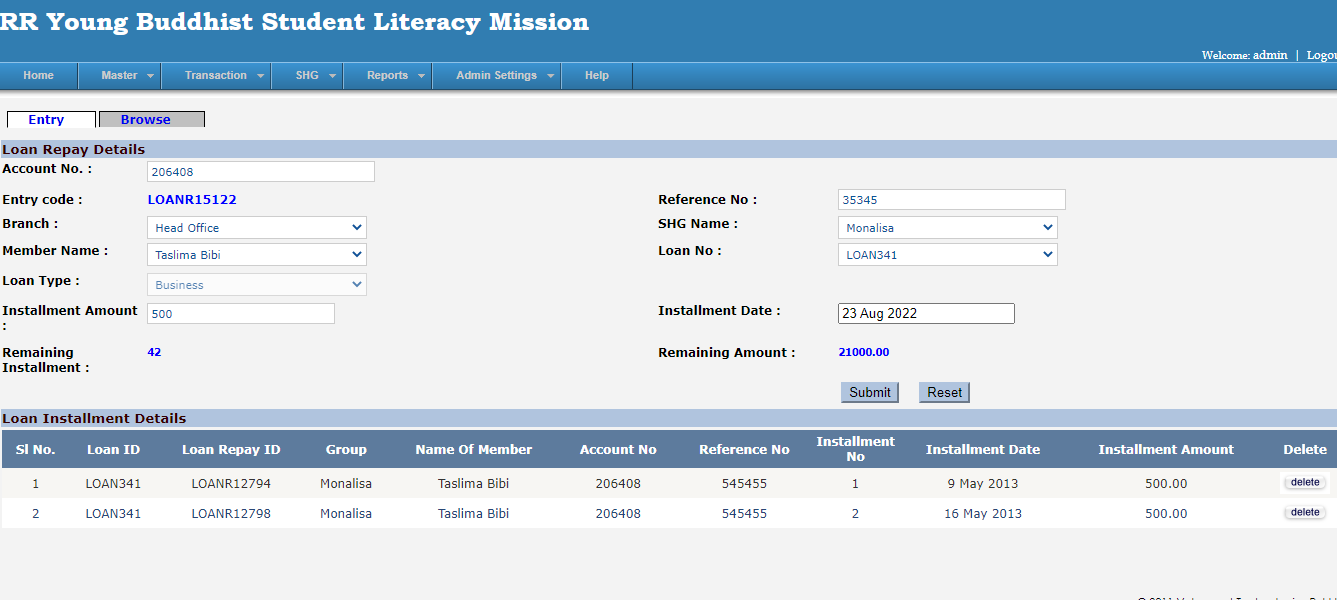

Loan Repay in Microcredit Software

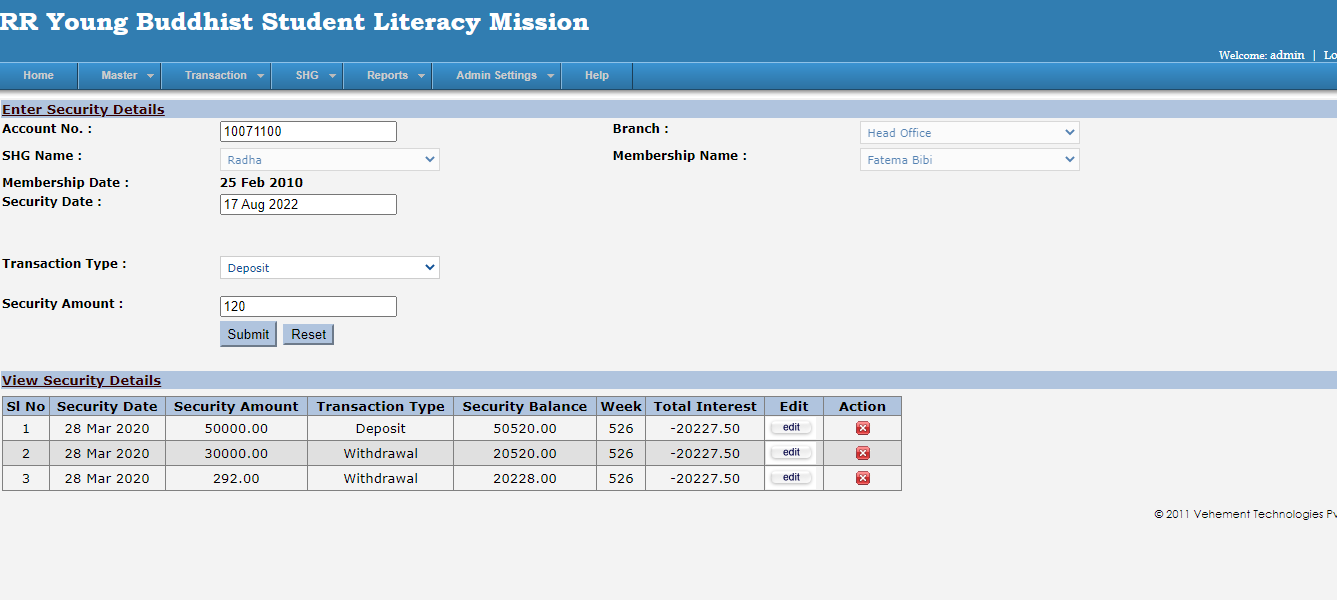

Security Deposit in Microfinance Software

Memberwise Security Details in MFI